By Marty Mayfield

KRTN Multi-Media

The city of Raton will finalize their budget this month and send it to the state auditor for final approval for the 2014-2015 fiscal year.

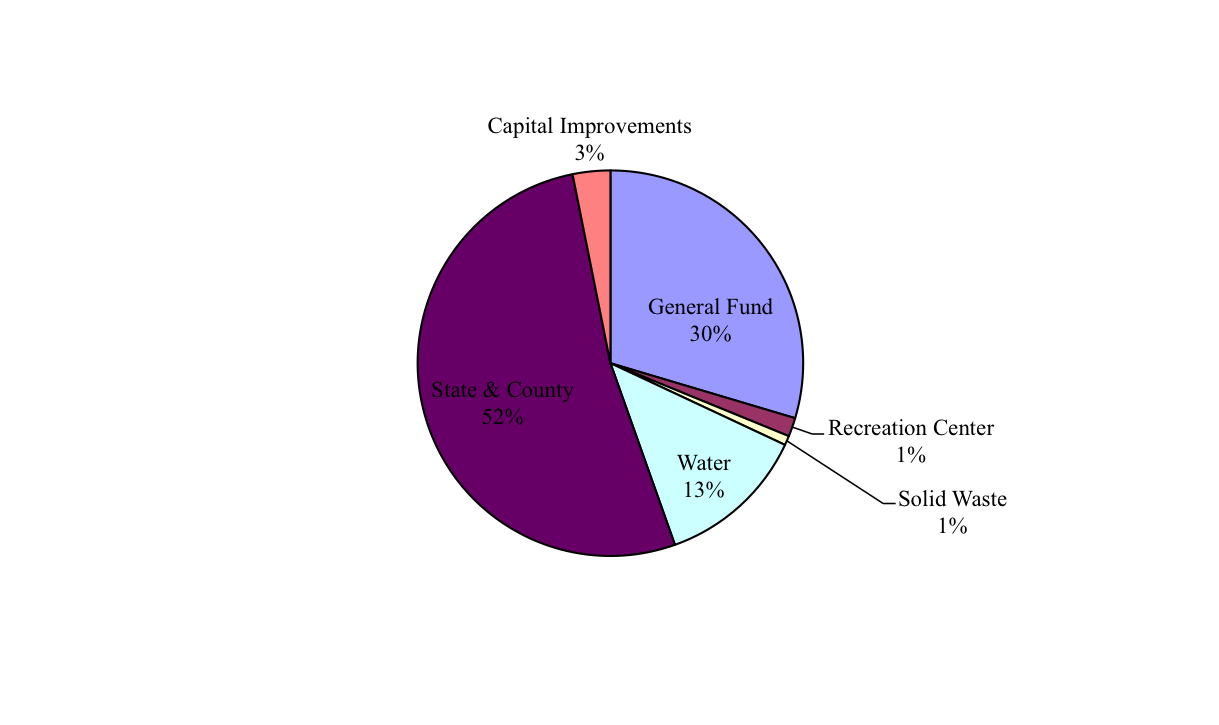

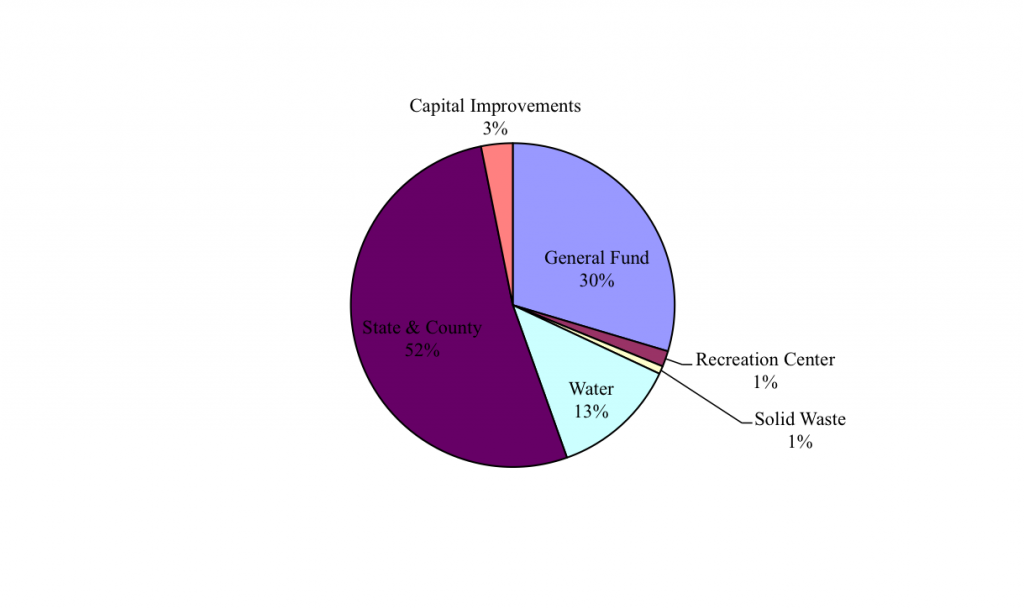

The city relies heavily on gross receipts taxes (GRT) as its primary source of income and that has always been an area of controversy between the city and citizen groups in Raton. This year it is estimated that 60% of the city’s revenue will be from GRT.

But did you know that of the 7.9375% GRT collected by local businesses the city only gets 2.5625%. That’s right, the state of New Mexico gets the lion’s share at 5.125% and the county only gets a measly .25%.

Below is the break down of the city’s gross receipts taxes and how it is designated into the separate funds:

|

TAX RATES |

|

|

City – Local Options |

1.0000% |

|

Local Options – Capital Impr |

0.2500% |

|

General Infrastructure |

0.1250% |

|

Swim Pool/Rec. Center |

0.1250% |

|

Water |

1.0000% |

|

Environmental |

0.0625% |

|

2.5625% |

|

|

State |

5.1250% |

|

County |

0.2500% |

|

7.9375% |

Businesses within the city limits of Raton collect the gross receipts tax from anyone who buys goods or services. That anyone includes travelers, tourist, and businesses doing construction work just to name a few. The advantage to the residents of Raton is that others help pay that tax and provide revenue for the city. It is not just a burden to the residents of Raton.

Businesses in Raton collect the tax on top of the price of goods and services and then send the taxes collected to the state. According to the filing report provided by the state Taxation and Revenue Department those taxes are due in to the state by the 25th of the following month. In other words for taxes paid in January are due in to the state by February 25. The state then provides each municipality with a tax report and according to city Treasurer Michael Ann Antonucci the city receives a check from the state two months later. For taxes paid in January the city receives a check in March.

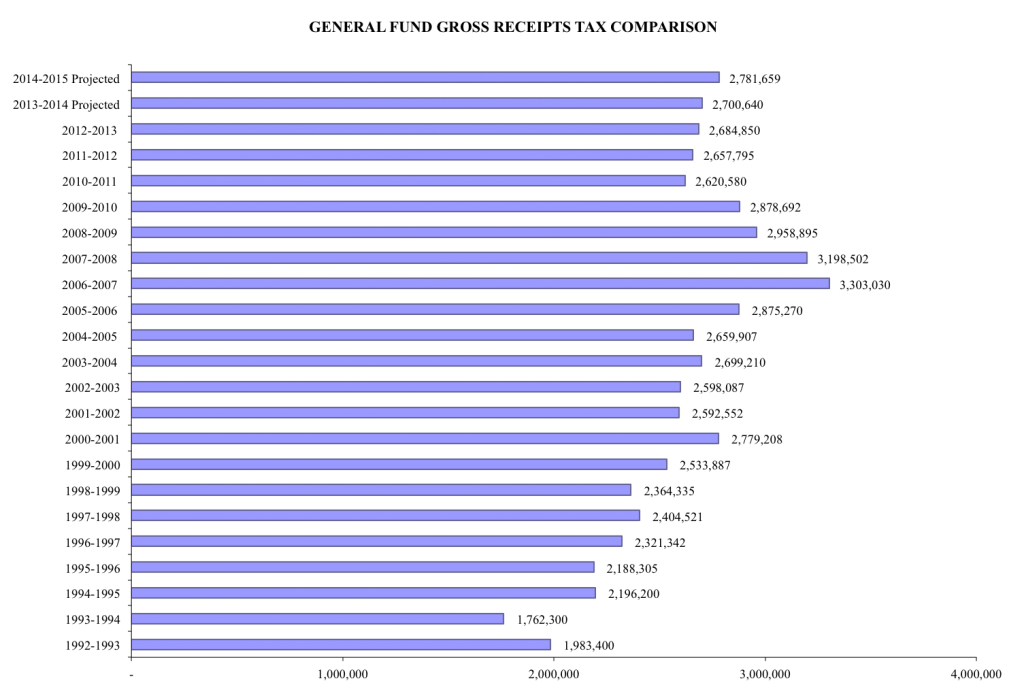

The problem with the GRT is that it is dependent on the economy and fluctuates accordingly. So one year the actual GRT may be less than estimated by the city during the budget process. When that happens the city has to tighten its belt and at times may have to cut services. If the economy does well and the GRT is better than expected the city tries to play catch up and get things that are neglected done. Below are the actual GRT figures for the city of Raton and these figures are just a small part of what the city uses to estimate the GRT for the next year.

|

Year |

Revenue |

|

1992-1993 |

1,983,400 |

|

1993-1994 |

1,762,300 |

|

1994-1995 |

2,196,200 |

|

1995-1996 |

2,188,305 |

|

1996-1997 |

2,321,342 |

|

1997-1998 |

2,404,521 |

|

1998-1999 |

2,364,335 |

|

1999-2000 |

2,533,887 |

|

2000-2001 |

2,779,208 |

|

2001-2002 |

2,592,552 |

|

2002-2003 |

2,598,087 |

|

2003-2004 |

2,699,210 |

|

2004-2005 |

2,659,907 |

|

2005-2006 |

2,875,270 |

|

2006-2007 |

3,303,030 |

|

2007-2008 |

3,198,502 |

|

2008-2009 |

2,958,895 |

|

2009-2010 |

2,878,692 |

|

2010-2011 |

2,620,580 |

|

2011-2012 |

2,657,795 |

|

2012-2013 |

2,684,850 |

|

2013-2014 Projected |

2,700,640 |

|

2014-2015 Projected |

2,781,659 |

GRT is the big reason that economic development and other organizations within a municipality push to shop at home. This year the city is hoping to see about $2,781,659 in GRT which figures to 60% of this year’s budget. Below are the figures for revenues and expenses for this year’s city budget.

|

TAXES |

||

|

Gross Receipts Tax |

2,781,659 |

60.13% |

|

Property Tax |

653,272 |

14.12% |

|

Franchise Tax |

202,519 |

4.38% |

|

Motor Vehicle Tax |

14,000 |

0.30% |

|

Cigarette Tax |

– |

0.00% |

|

Comp Tax |

12,000 |

0.26% |

|

Total Taxes |

3,663,450. |

79.20% |

|

FEES CHARGED |

||

|

Rents & Services |

628,600 |

13.59% |

|

Fines & Forfeitures |

37,000 |

0.80% |

|

License & Permits |

23,800 |

0.51% |

|

Total Fees |

689,400 |

14.90% |

|

MISCELLANEOUS |

||

|

Miscellaneous |

24,200 |

0.52% |

|

Grants |

248,750 |

5.38% |

|

Total Misc. |

272,950 |

5.90% |

|

Total Revenues |

4,625,800 |

100.00% |

|

Department |

Expenses |

|

Executive |

668,299 |

|

Library |

203,016 |

|

Public Works |

559,893 |

|

Building Maint. |

138,744 |

|

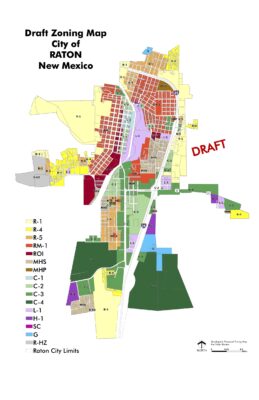

Zoning |

18,752 |

|

Fire |

1,046,499 |

|

Dispatch |

310,050 |

|

Police |

1,336,043 |

|

Airport |

40,450 |

|

Legislative |

32,006 |

|

Comm Development |

18,335 |

|

Animal Control |

73,846 |

|

Judicial |

92,212 |

|

4,538,145. |

|

The Raton City Commission will meet again on July 22 to discuss and finalize the budget for fiscal year 2014-2015.

[…] a complete run down on the GRT see the story Gross Receipts Tax City’s Prime Income on our web […]